Understanding drawdown rules is the key to surviving any prop firm challenge. With TradeXMastery, strict limits are in place across all funding models — Two-Phase, One-Phase, and Instant Funded accounts. These limits are designed to protect capital and ensure traders show discipline, not just luck.

In this guide, we’ll break down how daily and overall drawdown work in each model, with simple examples you can follow.

What Is Drawdown in Prop Trading?

In simple terms, drawdown is the maximum amount you can lose before your account is closed. TradeXMastery uses two types of drawdown:

- Daily Drawdown – the maximum you can lose in a single day.

- Overall Drawdown – the maximum you can lose in total, from the starting balance or equity peak.

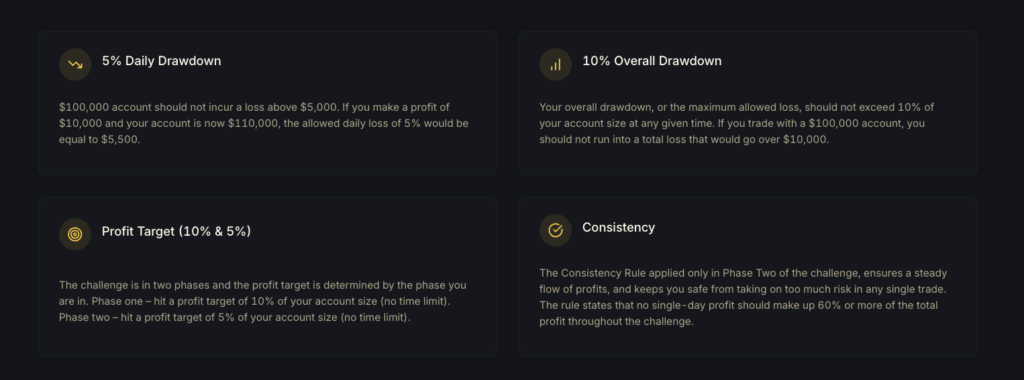

Two-Phase Challenge Drawdown

The Two-Phase Evaluation is the standard model with a 10% profit target in Phase 1 and 5% in Phase 2.

- Daily Drawdown Limit: 5% of account equity at the start of the trading day.

- Overall Drawdown Limit: 10% of the account balance (trailing).

Example:

- Starting balance: $100,000

- Daily drawdown: $5,000

- If your balance grows to $110,000, the next day’s daily limit increases to $5,500.

- Your total account must never fall below $90,000 (10% overall drawdown).

Key Point: Even if you finish a day in profit, the daily loss limit resets based on the new equity.

One-Phase Challenge Drawdown

The One-Phase Evaluation is faster to complete, requiring only a 5% profit target. To balance this easier goal, the drawdown rules are stricter.

- Daily Drawdown Limit: 4%

- Overall Drawdown Limit: 7%

Example:

- Starting balance: $100,000

- Daily drawdown: $4,000

- Overall drawdown: $7,000

- Your account must never fall below $93,000, no matter how long you trade.

Key Point: The smaller buffer means risk management must be tighter. A single over-leveraged trade can end the challenge.

Instant Funded Accounts Drawdown

With Instant Funded Accounts, you skip the evaluation stage and start trading straight away. The rules here are almost identical to the One-Phase challenge.

- Daily Drawdown Limit: Around 4%

- Overall Drawdown Limit: Around 7%

Example:

- Starting balance: $50,000

- Daily drawdown: $2,000

- Overall drawdown: $3,500

- If your balance drops to $46,500, the account is closed.

Key Point: Since there is no evaluation period, the drawdown rules act as the only protection for the firm’s capital. Violations result in immediate termination.

How the Rules Apply After Funding

Passing the evaluation (or buying an instant account) doesn’t remove the limits — they carry over into the funded phase.

- Two-Phase Funded Accounts: 5% daily, 10% overall.

- One-Phase & Instant Funded Accounts: 4% daily, 7% overall.

If you breach either limit, the funded account is closed, even if you’ve been profitable before.

Daily vs Overall Drawdown – Key Differences

It’s important to understand the relationship between the two:

- The daily drawdown resets each day based on equity at market open (00:00 server time).

- The overall drawdown is fixed relative to your starting balance or highest equity, and it does not reset.

Scenario Example:

- $100,000 starting account.

- Day 1: You lose $3,000 → still safe (under 5% daily).

- Day 2: You lose another $3,000 → total $6,000 down. You’re now dangerously close to the 10% overall limit.

- Even though each individual day stayed within the 5% rule, the cumulative $6,000 loss matters for overall drawdown.

Why These Rules Matter

TradeXMastery’s drawdown system is built to enforce:

- Discipline: Prevents traders from taking oversized risks.

- Consistency: Ensures growth is steady instead of relying on one lucky trade.

- Longevity: Protects both the trader’s chance of staying in the challenge and the firm’s capital.

Final Thoughts

Every prop firm has drawdown rules, but TradeXMastery is clear and strict in enforcing them. Whether you’re in the Two-Phase, One-Phase, or Instant model, knowing your daily cap and overall buffer is the difference between lasting long enough to get funded or losing the account on a single bad trade.

For traders serious about passing and staying funded, risk management around these rules isn’t optional it’s the foundation.

Related: Full Guide to TradeXMastery Rules